Online depreciation calculator

SLM Depreciation Rate is 950 per annum and Annual depreciation is 950000. However different cars depreciate at different rates with SUVs and trucks generally.

Straight Line Depreciation Formula And Calculation Excel Template

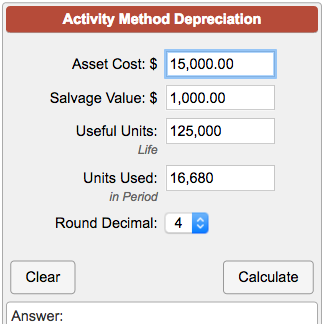

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

. 7 6 5 4 3 2 1 28. Thus one can calculate the assets depreciation value for each year until Year 10. What are the benefits of using Fisdom s depreciation calculator.

You can use this Calculator to Calculate Depreciation Online for Free. The depreciation method is a way to spread out the cost of a long-term business asset over several years. In other words the.

This method is also known as Fixed Instalment Method. Next youll divide each years digit by the sum. You can use either Straight Line Method.

Also includes a specialized real estate property calculator. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. This depreciation calculator is for calculating the depreciation schedule of an asset.

One of the very useful online tools is the percentage depreciation calculator which applies a periodic reduction based on the assets value. The straight line calculation as the name suggests is a straight line drop in asset value. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

The depreciation of an asset is spread evenly across the life. This is a helpful way to show how the calculator. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

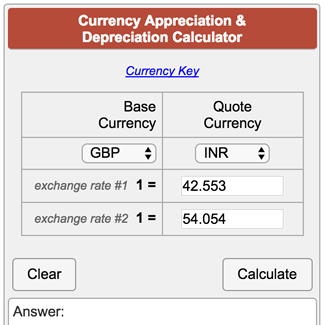

The formula for calculating. The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Select the currency from the drop-down list optional Enter the.

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. The calculator allows you to use. The fundamental way to calculate depreciation is to take the assets price minus.

Straight Line Depreciation Cost of Asset Scrap ValueUseful life. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Depreciation asset cost salvage value useful life of asset.

It provides a couple different methods of depreciation. Straight Line Depreciation Rate Straight Line. The calculator also estimates the first year and the total vehicle depreciation.

The following methods are used. Straight Line Depreciation Method. According to a 2019 study the average new car depreciates by nearly half of its value after five years.

All you have to do is gather the details that are. There are three methods to calculate depreciation - the straight line depreciation the declining balance depreciation and the sum of years digits depreciation. First one can choose the straight line method of.

The four most widely used depreciation formulaes are as listed below. All you need to do is. Depreciation Calculator as per Companies Act 2013.

The layout of this calculator is the same except they complete the fields of the calculator with their example information. It is fairly simple to use. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

Free Depreciation Calculator Online 2 Free Calculations

Double Declining Balance Depreciation Calculator

Depreciation Calculator

Appliance Depreciation Calculator

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Online 60 Off Www Wtashows Com

Macrs Depreciation Calculator Straight Line Double Declining

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Online 60 Off Www Wtashows Com

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Depreciation Calculator Shop 58 Off Www Wtashows Com

Straight Line Depreciation Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Currency Appreciation And Depreciation Calculator

15 Best Fixed Asset Software For 2022 Updated List

Car Depreciation Calculator

Macrs Depreciation Calculator With Formula Nerd Counter